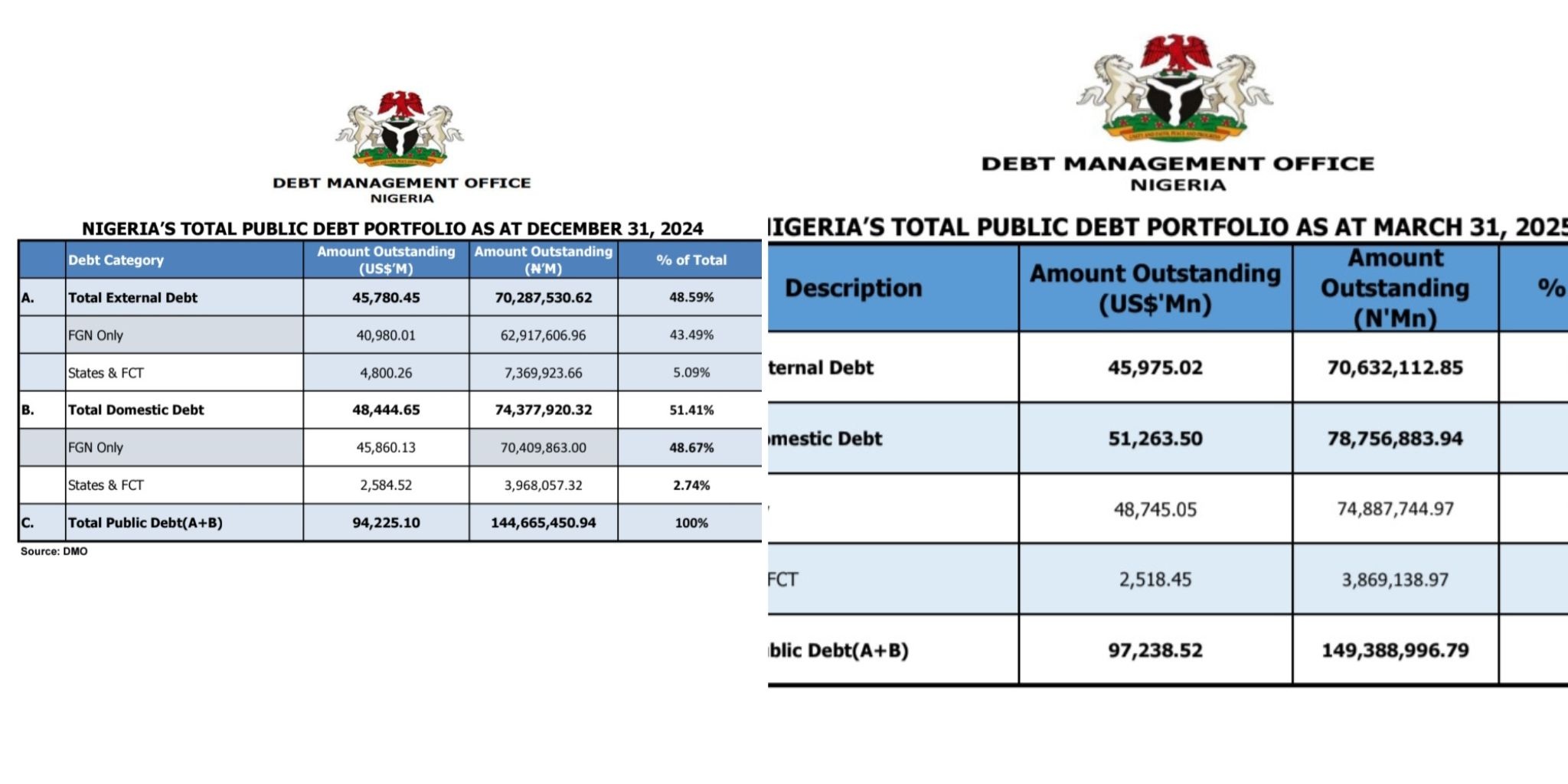

A recent analysis of data from the Debt Management Office (DMO), conducted by SaharaReporters, reveals that Nigeria’s public debt has surged to ₦149.3 trillion as of March 31, 2025.

This marks a significant jump from the ₦144.6 trillion reported at the close of 2024, reflecting a continued upward trend in the nation’s debt profile despite longstanding government promises to reduce reliance on borrowing.

The data breakdown indicates that most of the increase stems from domestic debt, which grew by a staggering ₦4.4 trillion in just three months.

Domestic obligations stood at ₦78.7 trillion at the end of Q1 2025, up from ₦74.3 trillion in December 2024.

Meanwhile, external debt rose more modestly by ₦350 billion, inching up from ₦70.28 trillion to ₦70.63 trillion over the same period.

This persistent rise underscores a broader pattern of escalating indebtedness.

Back in September 2024, Nigeria’s total public debt stood at ₦142 trillion.

By December, it had climbed to ₦144.6 trillion, and now, just three months later, it has breached the ₦149 trillion mark.

In less than a year—from June 2024 to March 2025, Nigeria’s debt stock ballooned from ₦134.2 trillion to ₦149.3 trillion, representing a nearly ₦15 trillion increase.

Further examination of the DMO figures reveals a consistent leaning toward domestic borrowing.

As of September 2024, domestic debt accounted for ₦73.4 trillion of the total.

The federal government alone was responsible for ₦69.2 trillion of that figure. State governments and the Federal Capital Territory (FCT) collectively owed ₦4.2 trillion.

This reliance on domestic financing has continued into 2025, reflecting the government’s preference for internal borrowing over sourcing funds externally.

The pattern is clear: while external debt has risen incrementally, from ₦63 trillion in June 2024 to ₦70.63 trillion in March 2025, the bulk of Nigeria’s borrowing remains concentrated within its borders.

In June 2024, the country’s domestic debt stood at ₦71.2 trillion, a number that has since climbed by more than ₦7 trillion.

This growing debt burden stands in stark contrast to the pledges made by President Bola Tinubu’s administration.

In August 2023, during the inauguration of the Presidential Committee on Tax Reforms, President Tinubu made a public commitment to shift away from excessive borrowing.

According to a statement published on the official State House website, Tinubu pledged to “break the vicious cycle of overreliance on borrowing for public spending.”

He also pledged to alleviate the strain that debt servicing places on Nigeria’s limited government revenues.

However, the data tells a different story.

Not only has borrowing continued, but it has also accelerated, raising concerns about the country’s fiscal sustainability.

Critics argue that despite reforms in taxation and spending, the federal government has not sufficiently curbed its appetite for debt.

Economic analysts warn that Nigeria’s increasing debt levels could have long-term implications.

These include higher debt servicing costs that divert funds from critical sectors like healthcare, education, and infrastructure.

Already, a significant portion of national revenue is allocated to repaying loans, leaving little room for development-focused spending.

The continued accumulation of debt, particularly from domestic sources, suggests that the federal government is prioritizing short-term financing needs over long-term fiscal stability.

This strategy, while possibly convenient in the face of low investor confidence or challenging global credit conditions, risks compounding Nigeria’s economic vulnerabilities.

With the country’s public debt now approaching the ₦150 trillion threshold, pressure is mounting on the Tinubu administration to honor its commitment to fiscal discipline.

The coming months will test the government’s resolve to implement meaningful reforms, boost revenue generation, and manage public spending more prudently.

For now, the numbers speak louder than promises.

Nigeria’s debt continues to climb, casting doubt on official reassurances and raising pressing questions about the nation’s economic direction.