Featured

Foremost capital overtakes rivals, hits ₦60bn amid doubts

DDM News

Foremost Capital Limited has hit a historic milestone, exceeding ₦60 billion in assets under management (AUM) just six months after commencing operations.

Diaspora Digital Media (DDM) gathered that the Securities and Exchange Commission (SEC)-licensed firm has quickly positioned itself as a leader in Nigeria’s investment space, gaining investor confidence during a time when many are pulling funds from traditional firms.

The firm, which offers both conventional and Shariah-compliant investment products, is rapidly redefining wealth creation for individuals and institutions nationwide.

Its product suite includes portfolio and fund management, liquidity optimization, and financial advisory services, all structured around transparency and strategic innovation.

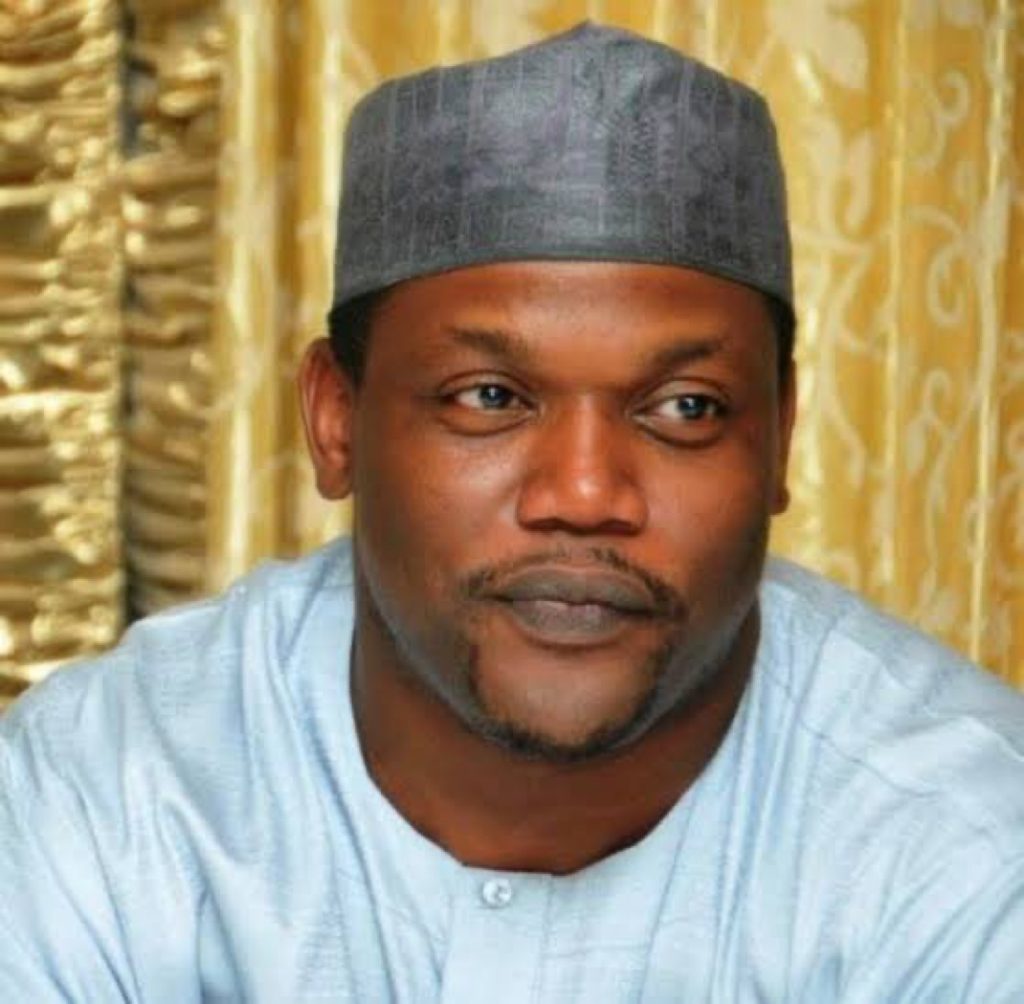

The company’s Managing Director and CEO, Mr. Emmanuel Akehomen, spoke to journalists in Abuja during an investment forum over the weekend.

He emphasized that the firm’s performance reflects more than just numbers, it represents a purpose-driven approach to asset management.

“In just six months, we have crossed the ₦60 billion mark in AUM. This isn’t just a milestone; it is a powerful statement about investor trust in our model,” Akehomen declared.

According to him, Foremost Capital’s broader vision is to become Africa’s most trusted and innovative asset management firm.

He noted that the company is pioneering the convergence of conventional and ethical investment strategies in a way that delivers sustainable value.

Akehomen attributed the firm’s rapid ascent to its unwavering commitment to transparency, client satisfaction, and transformative financial solutions.

He described Foremost Capital not as a new entrant but as a forward-thinking disruptor with long-term goals.

The CEO also revealed plans to launch mutual fund products in both Naira and USD denominations, further expanding the firm’s appeal to both retail and institutional investors.

These offerings will cover both conventional and Shariah-compliant structures.

In addition, the firm is set to unveil the Foremost Capital App, an innovative platform aimed at delivering competitive, risk-adjusted returns and seamless investment experiences.

The app will offer end-to-end investment tracking, customer support, and access to portfolio tools for their growing client base.

The company’s success comes at a turbulent time for Nigeria’s investment landscape, where many investors are reportedly withdrawing funds due to economic instability and trust deficits in legacy financial institutions.

However, Foremost Capital’s fast-growing base of satisfied clients points to a potential market shift, one that rewards transparency, ethics, and innovation over the old guard’s complacency.

As more investors seek secure and future-proof options, Foremost Capital appears poised to redefine the next chapter of asset management in Nigeria.

👇👇👇

Follow DDM’s official WhatsApp Channel for real-time updates.

https://whatsapp.com/channel/0029Vajkwdc4dTnFHl19vW3g

For Diaspora Digital Media Updates click on Whatsapp, or Telegram. For eyewitness accounts/ reports/ articles, write to: citizenreports@diasporadigitalmedia.com. Follow us on X (Fomerly Twitter) or Facebook