Prominent pro-Democracy group – Human Rights Writers Association 0f Nigeria (HURIWA) has castigated the National Bureau of Statistics (NBS) for breaching scientific methodology and accuracy of existential, real time facts in reaching a jaundiced determination of what it calls Nigeria’s unemployment rate that in their imagination has recorded a dramatic drop from 33.1 per cent reported in March 2021 to 4.1 per cent for the first quarter of 2023.

HURIWA, in a statement entitled “Recent unemployment statistic a product of political blackmail, highly unscientific and unreal“, said the current unemployment data by NBS were generated as a result of intensive and well-oiled political blackmail and media propaganda orchestrated straight from the office of the President of Nigeria just to get a quick response to the groundswell of concerns, consternation and worries of millions of Nigerians about the high costs of living and the high inflation rate created by the upward review in the pump price of petrol which has had a spiral effects on the costs of foodstuffs and services in Nigeria.

The National Bureau of Statistics (NBS), it would be recalled, disclosed on Wednesday, when it released its employment data for the first quarter of 2023, indicating a substantial improvement in the job market. It further stated that in Q1,2023, 92.6 per cent of employed persons in Nigeria were in informal employment, which includes agriculture, while 89.4 per cent in informal employment that excludes agriculture.

HURIWA has, however, blamed the NBS for capitulating to a well-orchestrated political propaganda from the office of the Nigerian President which has since the time of the immediate past president, produced by the same All Progressives Congress, had blackmailed the National Bureau of Statistics for displaying boldness, charismatic courage and candour, frankness and for relying on credible facts and figures to draw up conclusions on the unemployment or poverty related data about Nigeria and Nigerians.

“Appearance of this political piece of jaundiced propaganda by the Tinubu’s government through a contrived unemployment data is far removed from the realities of life in Nigeria of today,” HURIWA asserted.

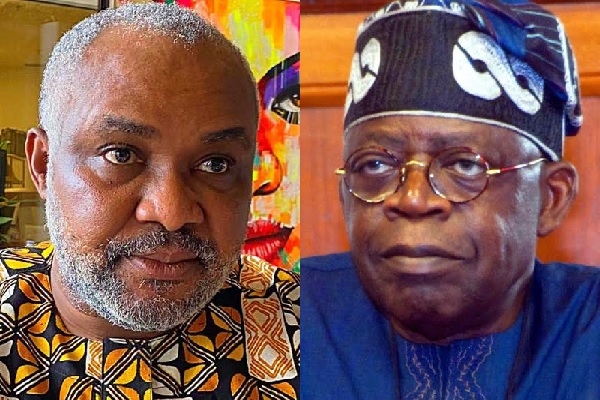

It said the current Special Adviser Media and Publicity to President Bola Tinubu who was then a special assistant on media to the then President Muhammadu Buhari had lambasted the NBS for being factually accurate and apolitical with their published statistical data just as he spared no words to discredit the work of this publicly funded agency of the central government.

HURIWA, which rubbished the most recent publication on the unemployment rate by the NBS under a new hierarchy, affirmed that the NBS must have relied on voodoo and imaginary reasons when the bureau said the revised methodology defines employed persons as individuals who are working for pay or profit and who worked for at least one hour in the last seven days against 40 hours.

“The old methodology placed a range on the working-age population- 15 – 64 years, while considering working hours between 20-39 hours as underemployment, 1-19 hours as unemployment,” it added.

The human rights group noted that only someone who resides in the moon or other strange planets wouldn’t know that the N1,000 paid mostly for one hour menial job can’t possibly be classified as a minimum or living wage and this then calls to question what the NBS means by 1 hour employment out of seven days.

“So, if someone earns N1k per one hour in a whole of 7 days, how does he feed himself, his family household and other dependents and buy the costly fuel to power his ‘I pass my neighbour’ generator due to erratic electricity power supply?”

It recalled that the Bureau in its latest publication also announced that the unemployment rate as of the fourth quarter 2022 was 5.3 per cent. These were contained in the fourth quarter 2022 and first quarter 2023 Nigeria Labour Force Survey (NLFS) report launched on Thursday in Abuja.

HURIWA attributed this watering down of the statistics to satisfy political wishes of the President Tinubu’s government just like his predecessor, to wishful propaganda because according to HURIWA, the Presidency had in 2022 attacked the NBS when around March 2021 it accurately reported that Nigeria’s unemployment rate rose to 33.3 per cent, translating to some 23.2 million people, the highest in at least 13 years and the second-highest rate in the world.

“The figure jumped from 27.1 per cent recorded in the second quarter of 2020 amid Nigeria’s lingering economic crisis worsened by the Coronavirus pandemic,” it recalled.

HURIWA, which backed analysts for saying that the unemployment statistics with the updated methodology do not reflect the true number of jobless people in Africa’s most populous country, where many have lost their jobs as a result of surging inflation and where the government has struggled to create enough jobs, cautioned the NBS to stop driving the agency to the Golgotha of doubts, cynicism and deceitful tendencies.”

The group said: “You do not need rocket science to ascertain correctly that the true unemployment rate in Nigeria might be more than the 33 per cent recorded in 2020 when the NBS last released the labour data, as said by a statistical expert Akintunde Ogunsola, an Abuja-based financial analyst.”

He said many businesses in the micro, small and medium enterprise sector — a significant part of the economy — have been forced either to lay off some workers or shut down.

HURIWA recalled that the unemployment rate in the country had more than quadrupled since 2016 when the economy slipped into a recession during the last administration of former President Muhammadu Buhari, as canvassed by experts.

It condemned the National Bureau of Statistics for surrendering to political blackmail from the office of the President, and recalled that in April 2021, the then Minister of Labour, Dr. Chris Ngige, claimed that the World Bank questioned the methodology employed by NBS to generate its employment statistics, adding that he had on several occasions queried the employment statistics released by the agency. This statement was then contradicted by the hierarchy of the NBS then.

Besides, on February 3, 2022, the office of the President upped its attack by stating without justification that the National Bureau of Statistics (NBS) data are always wrong.

HURIWA recalled that the then Senior Special Assistant to the President on Public Affairs to then President Muhammadu Buhari, Ajuri Ngelale, who is now Special Media Adviser to President Bola Ahmed Tinubu disclosed this in an interview with Trust TV’s Daily Politics on Wednesday, February 3rd 2022.

Ngelele said the NBS usually gives out the wrong statistics of unemployed adults in the country.

Ngelele had said then that the agency doesn’t have the required manpower to produce accurate data. His words; “The Statistician-General told us that we have a handful of NBS staff.

“Go to the NBS yourself and see what their employment rolls look like; how many staff do they have to be able to send out to the nooks and crannies of the entire Nigerian federation. They send out a handful of people state by state,” Ngelele insisted.

According to him, the NBS figures failed to capture those in the informal sector.

Ngelele said: “I am saying very clearly that the NBS has a serious problem with accurate data till today.

““The same statistics suggested that somewhere in 2014, that the unemployment rate on the nation was eight percent that is less than 10 percent… will you suggest anytime in your lifetime in this country, Nigeria, that we are all living in, that out of the adult population in the country, with well over a 100 million people, that 92 million out of the working adults, even worst that.”

HURIWA, therefore, cautioned the current hierarchy of the NBS to either carry out their duties as scientists that depend on verifiable evidence and not voodoo and imaginative thinking, or else Nigerians will begin to take anything coming from the NBS under the current administration as politically manipulated, unreliable, unscientific and unverified conjectures.

The Rights group stated that unemployment rate in Nigeria is even higher than the 33% stated by NBS two years ago that attracted the political anger of the office of President which has been carried over to the current government since the principal character that launched the scathing criticism against the NBS last year is still in government and occupying even a higher office as the Special Adviser on Media and Publicity to the current President.

HURIWA is therefore charging Nigerians to realise that the most current unemployment data from the President Tinubu’s controlled NBS is warped, manipulated and manufactured to satisfy political agenda of the current government over a long term. Read more.

—