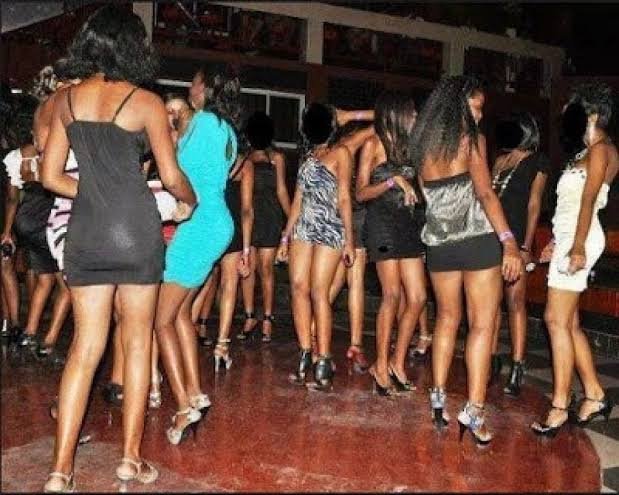

Chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, Taiwo Oyedele, has said sex workers in Nigeria are liable to pay tax under the new reform laws signed by President Bola Ahmed Tinubu.

Oyedele made this statement during a lecture on tax education at the Redeemed Christian Church of God (RCCG) in Lagos.

In a video circulatingonline, the fiscal policy expert explained that taxes apply once there is an exchange of value.

He used the example of sex workers, noting that as long as they render a service and receive payment, they are legally bound to pay tax.

“If somebody is doing ‘run girl,’ they look for men to sleep with; you know that’s a service, they will pay tax on it,” Oyedele stated.

He further explained that the law does not distinguish between legitimate or illegitimate sources of income.

“One thing about the tax law is, it does not separate whether what you’re doing is legitimate or not, it just asks you whether you have an income,” he added.

This clarification comes after President Tinubu signed four major bills into law on June 26, 2025.

These include the Nigeria Tax Act, the Nigeria Tax Administration Act, the Nigeria Revenue Service Establishment Act, and the Joint Revenue Board Establishment Act.

Collectively called the Tax Acts quartet, the reforms aim to expand Nigeria’s tax base and improve compliance across federal, state, and local governments.

Oyedele, who is Fiscal Policy Partner and Africa Tax Leader at PricewaterhouseCoopers, was appointed by Tinubu to lead the committee.

The body includes experts from both the private and public sectors and is tasked with simplifying Nigeria’s tax system, boosting government revenue, and making compliance easier for citizens.

The comments about sex workers have sparked debate, as many Nigerians question how the government intends to enforce taxation on informal and controversial professions.

However, tax experts argue that the broader message is clear: all income earners, regardless of their profession, are within the tax net under the new laws.