Economy

Chevron’s tengiz expansion boosts oil output amid cost overruns and geopolitical challenges

DDM News

Chevron has long reaped substantial profits from Kazakhstan’s Tengiz oil field, a key asset in its global portfolio.

Diaspora digital media (DDM) revaild that the field accounts for a significant portion of the landlocked country’s oil production and has been a major revenue source for the company for decades.

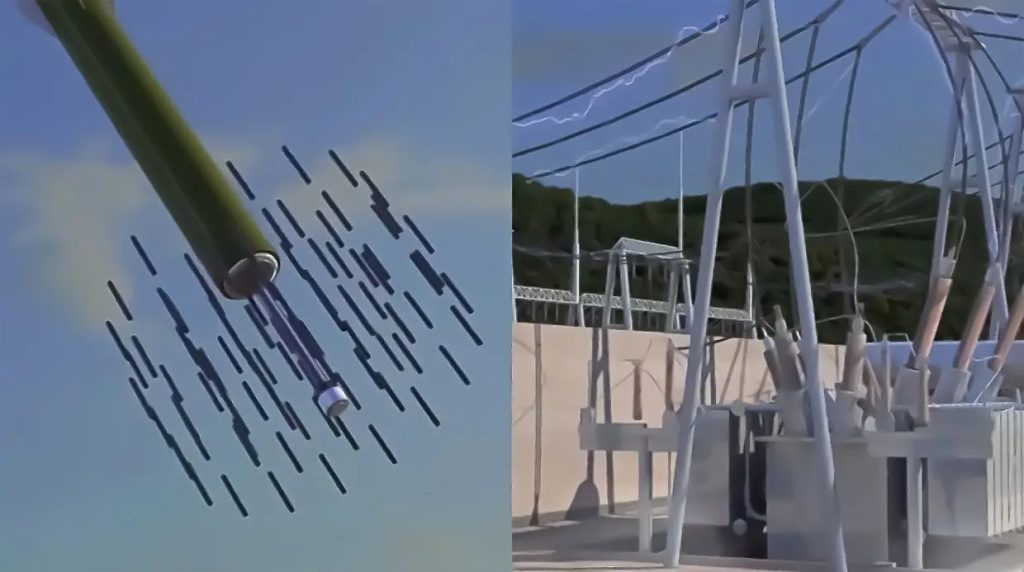

However, Tengiz’s exports are heavily reliant on a pipeline running through Russia to the Black Sea, meaning its trade flows are largely under Moscow’s control.

Despite these challenges, Chevron is pressing ahead with the field’s expansion, which is expected to significantly boost production.

The expansion is set to reach full capacity by June, at 260,000 barrels per day, bringing the total production at Tengiz to approximately 1 million barrels of oil equivalent per day.

Clay Neff, Chevron’s head of international exploration and production, confirmed the expected increase in production to Reuters.

While the project’s long-term financial outlook appears strong, Chevron’s stock faced a slight dip of 0.25%, closing at 1240 GMT.

The Tengiz expansion, however, has not come without its complications.

Since the project’s inception in 2012, it has experienced significant delays and cost overruns, pushing the investment to between $48 billion and $49 billion.

This makes the Tengiz expansion one of the world’s most expensive oil developments.

Despite these financial setbacks, Chevron remains committed to the project, which is expected to generate a substantial return over the next few years.

In fact, Neff predicts that the expansion will generate $4 billion in free cash flow in 2025, with that figure increasing to $5 billion in the following year, based on an average Brent crude price of $60 a barrel.

Currently, Brent crude is trading at approximately $80 per barrel, which boosts the expected profitability of the venture.

Chevron holds a 50% stake in the Tengizchevroil joint venture, which operates the Tengiz field.

Exxon Mobil owns a 25% stake, while Kazakh oil company KazMunayGas controls 20%, and Russian oil giant Lukoil holds the remaining 5%.

This joint venture structure reflects a mix of Western, Kazakh, and Russian interests, a situation that can sometimes create complexities, especially given Russia’s significant geopolitical influence over the pipeline used for exports.

Despite these challenges, Chevron’s involvement in Tengiz is crucial for the company’s growth strategy.

Neff explained that the expansion is not just about increasing immediate production; it also plays a key role in extending the lifespan of the Tengiz field.

This extension is vital for Chevron’s broader goal of boosting production by 3% annually over the next five years, alongside expansion in the U.S. Permian shale basin.

By focusing on both the Tengiz field and U.S. shale, Chevron is positioning itself for long-term growth and energy production.

The company’s involvement in the Tengiz expansion underscores Chevron’s commitment to maintaining a strong position in the global energy market, despite the challenges posed by geopolitical issues and rising development costs.

While the Tengiz field remains one of Chevron’s most important assets, it also represents the complexity of operating in regions where political and economic factors can influence the pace of development.

The pipeline through Russia highlights the vulnerability of export routes and the potential risks Chevron faces in securing a stable and profitable export infrastructure.

As the Tengiz expansion nears its full operational capacity, Chevron’s strategic focus remains on ensuring the long-term viability of the field while managing the significant costs associated with such a large-scale development.

In the context of global oil production, this expansion stands out not just for its size but for the intricate mix of investments, partnerships, and geopolitical considerations that shape its future.

With the expansion nearing completion, Chevron remains cautiously optimistic about the future financial performance of the Tengiz field, despite its past challenges.

For Diaspora Digital Media Updates click on Whatsapp, or Telegram. For eyewitness accounts/ reports/ articles, write to: citizenreports@diasporadigitalmedia.com. Follow us on X (Fomerly Twitter) or Facebook