Economy

FIN Insurance Company reports impressive growth in total assets, profits

FIN Insurance Company Limited has announced a significant increase in its total assets, reaching N21.1 billion in 2023, up from N12.7 billion in the previous year.

The company also reported a substantial rise in profits, with earnings soaring from N649.568 million in 2022 to N7.1 billion in the 2023 financial year.

Also, FIN Insurance’s gross premium experienced a remarkable 69.1% surge, climbing from N3.4 billion in 2022 to N5.8 billion in 2023.

The shareholders’ fund appreciated to N15.5 billion compared to N9.8 billion in the previous year.

Additionally, the solvency margin increased to over N12.5 billion from N8.5 billion in 2022.

In 2023, the company disbursed a total of N1.2 billion as claims to policyholders and achieved an underwriting profit of N0.2 billion.

The growth trajectory of FIN Insurance was attributed to strengthened business relationships, particularly with the brokers fraternity.

During the first bi-monthly NCRIB member’s evening of 2024 held in Lagos on 27th February 2024, the Managing Director of FIN Insurance, Mr. Bashir Binji, emphasized the company’s commitment to fostering business growth and enhancing partnerships with insurance brokers.

He acknowledged the crucial role brokers play in connecting insurers with clients and highlighted the significance of collaboration for industry success.

“At FIN Insurance, we recognize the integral role that brokers play in bridging the gap between insurers and clients.

“Your insights, relationships, and commitment to understanding the unique needs of your clients contribute significantly to the success of our industry,” explained Mr Binji.

He further pledged to develop specialized products to support brokers, assign individual responsibilities to their portfolio, and provide risk management assistance to brokers and their clients.

He also outlined plans for further enhancement of technical and technology teams to improve service capacity, increase transaction efficiency, facilitate information sharing, and enhance joint marketing efforts.

The president of NCRIB, Mr. Babatunde Oguntade, used the occasion to call on the federal government and relevant agencies to address the issue of food scarcity in the country.

He identified insecurity, including attacks on farmers, as a major factor contributing to the food shortage and urged prompt action to mitigate these challenges.

Established in 1981 as Yankari Insurance Company Limited and later rebranded as FIN Insurance Company Limited, the company has a rich history of providing insurance services.

Following acquisitions by various financial institutions, including FIN Bank Plc and Cornerstone Insurance Plc, FIN Insurance is now a member of the FCMB Group and the Cornerstone Group.

The impressive growth and strategic initiatives outlined by FIN Insurance demonstrate the company’s commitment to excellence, innovation, and sustainable business practices in the insurance industry.

With a focus on customer relationships, product development, and operational efficiency, FIN Insurance is poised for continued success and leadership in the insurance sector.

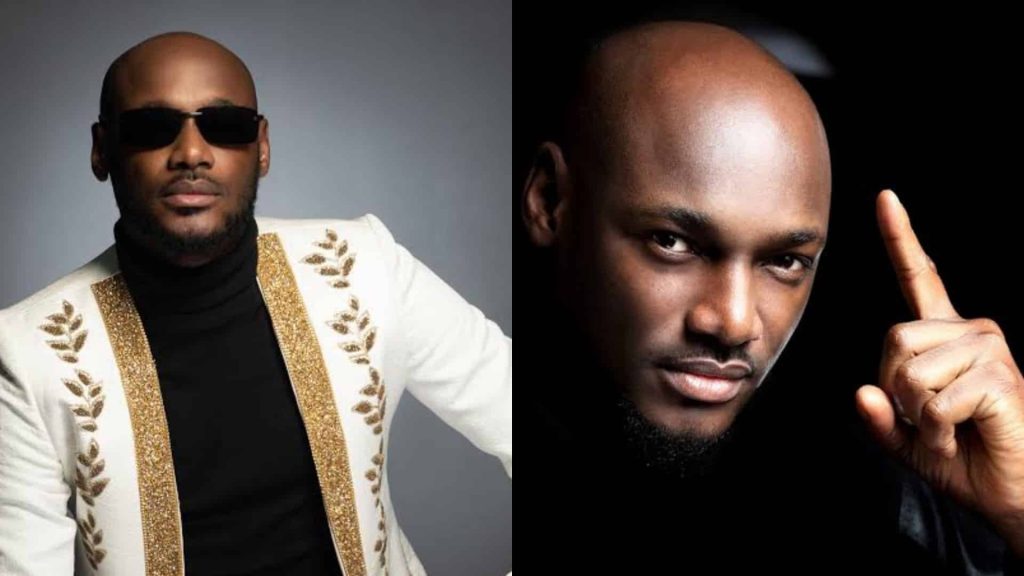

PHOTO: From left to right – Mr. Tope Adaramola, Executive Secretary/CEO, Mrs. Ekeoma Ezeibe, Deputy President of NCRIB, Prince Babatunde Oguntade, President of NCRIB, Mr. Bashir Binji, Managing Director/CEO FIN Insurance and Mr. Samuel Ohunusi, Executive Director, Technical FIN Insurance.

For Diaspora Digital Media Updates click on Whatsapp, or Telegram. For eyewitness accounts/ reports/ articles, write to: citizenreports@diasporadigitalmedia.com. Follow us on X (Fomerly Twitter) or Facebook