Economy

Nigeria’s Stock Market closes 2023 with stellar 45.9% gain, triumphing amid challenges

In a startling defiance of prevailing economic challenges, the Nigerian Exchange (NGX) closed 2023 on an upbeat note, recording a stellar 45.9% gain in its All Share Index (ASI).

This impressive performance, the best since the 50% surge in 2020, comes despite grappling with high inflation, a depreciating exchange rate, and ongoing security concerns.

The NGX’s rally this year marks its third-best showing in the last decade, only trailing the 50% rise in 2020 and 47% in 2013.

This achievement also places 2023 as the ninth most successful year in the exchange’s 39-year history.

Record-Breaking Closing Day

The NGX hit a new all-time high on the final trading day of 2023, with the ASI appreciating by 0.36% to close at 74,773.77 points, a jump from the previous day’s 74,502.58 points.

- Beginning the year at 51,251.06 points, the NGX notched an exceptional growth rate of 45.90% in 2023.

- In terms of market capitalization, there was a notable increase of N148 billion, with the year closing at N40.92 trillion, up from N40.77 trillion.

- Key market players such as MTNN, GTCO, BUAFOODS, and ZENITHBANK experienced significant shifts in their share prices during the day.

However, the star performer of the year was Transcorp Hotel, which posted an extraordinary gain of 1,022.9% in 2023.

Key Growth Drivers: Billionaire Influence and Banking Sector

A significant factor in this year’s stock market success has been the increased money supply, which reached N65 trillion as of September 2023.

- Nairametrics analysts opine this also drove investment in the sector due to the highly liquid nature of stock market trading.

- High-profile investments by billionaire investors such as Femi Otedola, Abdulsamad Rabiu, Tony Elumelu, and Aliko Dangote have been pivotal, bolstering market confidence as their associated companies led the charge among top performers.

- The banking sector experienced significant rallies, particularly benefiting from gains linked to the devaluation of the exchange rate. The Banking All-Share Index impressively returned 114.9%.

- Penny stocks, referred to as growth stocks on the NGX, also saw substantial gains, dominating the top 50 gainers chart.

The ‘Stocks Worth Over One Trillion’ (SWOOT) group significantly contributed to the market capitalization gains. Except for BUA Cement, all eight members of this elite group posted double-digit gains.

Notably, BUA Foods and Seplat recorded gains of 197% and 110%, respectively. Zenith Bank and GTB also made their entry into the SWOOT this year, with gains of 61% and 76%, respectively.

Market Highlights: Winners Outshine Losers

In a striking contrast, only 11 of the 156 listed stocks ended the year in negative territory, while 21 remained flat.

The lion’s share, about 121 stocks, reported double-digit gains, underscoring the broad-based nature of the rally.

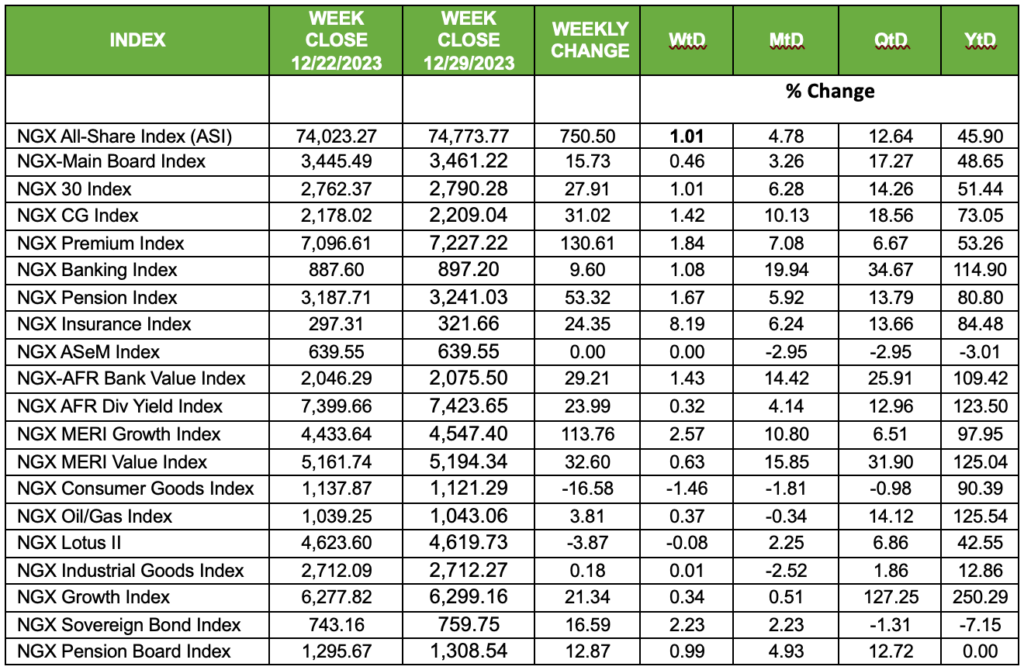

The massive gains also reflect across the major stock market indexes (see below).

2024 Outlook: Optimism Amidst Caution

As Nigeria’s financial market prepares to step into 2024, there’s a sense of cautious optimism among investors and analysts.

- While the NGX’s performance in 2023 showcases the resilience and potential of Nigerian equities, challenges such as inflation, currency volatility, and security issues remain key factors that could influence market trends in the upcoming year.

- For example, banking stocks are anticipated to face pressure due to a surge in fundraising activities. Banks are expected to bolster their share capital, potentially necessitating capital raises amounting to hundreds of billions.

- As global and local economic conditions continue to evolve, the Nigerian stock market’s ability to sustain this growth trajectory will be closely monitored.

The remarkable gains of 2023, however, have set a high benchmark and renewed confidence in the Nigerian financial sector’s resilience and potential for growth.

For Diaspora Digital Media Updates click on Whatsapp, or Telegram. For eyewitness accounts/ reports/ articles, write to: citizenreports@diasporadigitalmedia.com. Follow us on X (Fomerly Twitter) or Facebook